1) Headlines in mid-morning showed that the bank holiday in Cyprus has been unofficially extended for 2 more days.

2) ekathimerini, a Greek magazine reports on its site that the original demand, from the IMF and the German government on Friday, was for forfeiture of 40% of deposits. The 10% figure is the compromise.

3) Remember my post about Italy (and the goofy election results that followed their government’s attempt to get back on track)? Well, the chief economist at Commerzbank (a private German bank) has recommended to the German magazine Handelsblatt a 15% haircut for depositors in Italian banks.

4) About half of the deposits in Cyprus are Russian. And Cyprus is the largest source of foreign direct investment (buying and building physical stuff) into Russia. Clearly, this is laundering of dirty money by taking it out of Russia before putting it right back in again. Not surprisingly, Putin is ticked off about what amounts to a tax on reinvestment of ill-gotten gains.

5) Megan McArdle makes a good point at The Daily Beast:

Hopefully, savers will view Cyprus as an extreme one-off: a tiny nation whose banking system was unsustainably oversized for its economy, and whose substantial depositor base of kleptocratic foreigners made it uniquely difficult to deliver government support.

The problem is, Europe seems to be chock full of unique, one time problems with its banking system. There's a real risk that investors will decide that they'd rather not stick around to see what one-of-a-kind, custom-crafted solution the European ministers come up with next.

6) It appears that deposit insurance was a requirement imposed on Cyprus by the EU when they agreed to let Cyprus join. Of course, it was the EU that just abrogated the deposit insurance they made Cyprus offer.

7) The vote on the plan has been pushed back until Tuesday. It is not clear that it has the votes to pass the legislature in Cyprus. If it is voted down, speculation is that the banking system there will collapse, and the country is then likely to default.

8) Here’s another good quote from FT Alphaville:

A “one-off” often isn’t. Calling something after “stability” isn’t very stable. Saying that something is not a precedent usually makes it one.

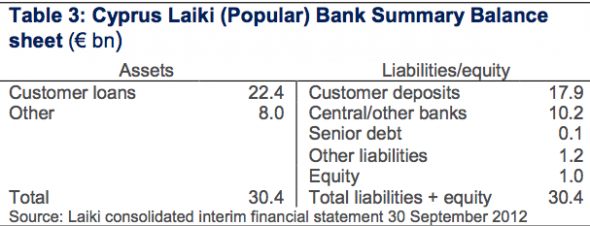

9) FT Alphaville also has the balance sheet of Laiki bank:

Note that there is almost no debt or equity. It’s all deposits. So this is less like a bank, and more like the wad of cash that people chip in and redistribute when there is a local tragedy. Also note that the “Central/other banks” entry is money already loaned by the European Central Bank under a program known as ELA. The EU refused to support Laiki on Friday because they already are supporting 1/3 of it.

10) Also, in the vein of “no one saw this coming”, FT Alphaville has a list at the bottom of the post with 10 previous articles about the decline of Cyprus.

No comments:

Post a Comment