It’s Tuesday morning. The interesting data news this morning is that the initial data on (nominal) retail sales shows a drop in February, but also that the revision of (nominal) retail sales for January also shows a large drop.

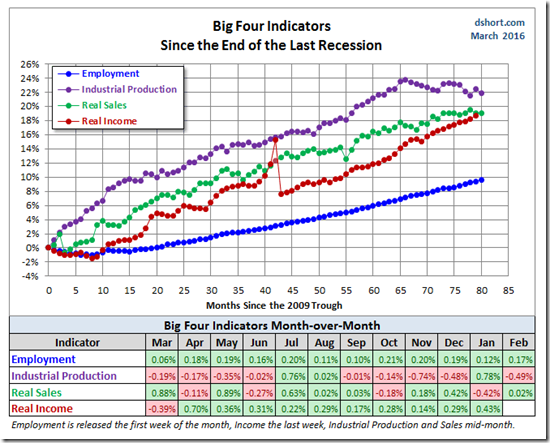

Real retail sales is one of the “big four” coincident indicators used to evaluate whether or not the economy has peaked.

To convert those nominal retail sales into real ones, we will have to wait for the release of the CPI for February. That’s at 6:30 tomorrow morning.

Lots of people will be watching that because recession indicators are being pulled down strongly by industrial production. This has been offset by good numbers in employment, real income … and real retail sales. If the initial numbers for that last one have fallen enough, then maybe we do need to be thinking that the economy has peaked.

*********************************************

March 16, 2016 @ 1:15

Here’s the updates.

Real (Retail) Sales fell in January, but grew ever so slightly last month. Industrial production had a good month in January. Put it all together, and it looks less like a peak than it did 2 months ago when we looked at this.

Keep in mind that these data series do continue to get revised. And, the NBER Business Cycle Dating Committee would wait until all those revisions are done to go and look several months back and pick out where the turning point occurred. What they’re doing here is mimicking that process.

Roughly, that is to add up all the current green ones (0.17 + 0.02 + 0.43 = 0.62), and all the consequtive pink ones within a row (just the –0.49 now), to get 0.13. The threshold I was looking for to declare a peak was –2.00 or below.

No comments:

Post a Comment