From June 28, 2018

Sometimes posts get lost. Sometimes they get abandoned. Often that’s because I can’t find the cite I need. I started this one in the summer of 2015, and returned to it 3 years later when the missing source material came across my screen.

Greece has improved a bit since then. Back then, it was slow motion train wreck of international macroeconomic news stories. I started this post the day that Greece defaulted on loans from the IMF. Headlines like this one were common: "Greece: The First Developed Country in History to Default to the IMF"

A problem when we in western developed countries think about Greece is that we think it’s one of us. It probably isn’t.

When we think about developed countries, we start with the U.S. What makes it developed? It isn’t that it’s GDP is big, but that it’s GDP per capita is big (and then maybe we exclude a few oil sheikdoms and offshore banking havens where the high GDP per capita might not be representative of actual citizens of those countries). Then we look around, and we see that there are places like Canada, Japan, Australia, Israel, and South Korea that are similar. But most of the similar countries are in Europe. But that starts with northwestern Europe (remember from middle school geography that Europe goes all the way to the Caucusus and Ural mountains). It’s easy for us to say that France, Germany, and the UK are also developed. And some smaller countries in and around them, like the Netherlands or Sweden or Austria. But as we stretch to the south and east, they get rarer. Italy is certainly developed. Spain … not so much. Croatia? Nope. Poland? It’s trying.

Here’s the thing. People are both inclusive and tribal. We have our tribes, but we do like to find new members too. What the EU and the EMU have been doing is adding countries from southern and eastern Europe that look less and less like those in northwestern Europe.† And then journalists call those countries “Developed”. They aren’t. Instead, they’re members of a club in which they’re still trying to fit in.

So when the headline reads that Greece is the first developed country to default on an IMF loan, the part that’s incorrect is probably the usage of “developed”. Just because people from developed countries are willing to vacation there doesn’t make it developed. Just ask Mexico.

And, in a very real sense, Greece is out of the news now because it defaulted then. Think of it like a company that’s faililng versus one that actually went bankrupt and was liquidated. Right now, the firm that’s in that situation is Toys ‘R Us. It’s been a company in decline for a decade. But remember all those warm fuzzys you have of it? In a few years it will be forgotten. Just like Child World has been. So Greece isn’t out of the news because the situation is all better, but rather because it crossed the threshold into bankrupty, and everyone gave up on it for a while.

***********************************************

From June 30, 2015

Greece has financial problems … and oh … Plato used to live down the street.

I think that the serious thinking of a lot of people about Greece’s problems starts to fall apart because they somehow think that Greece is special. We’d better off thinking about it as a place that was special.

Here’s a two question quiz: 1) name as many Greeks as you can who were born more than 2000 years ago, and 2) name as many Greeks as you can that were born in the last 2000 years? The problem is that we seem to get this Greek Derangement Syndrome because we don’t make the connection that all those Greeks from a long time ago don’t matter much to the Greece of today.

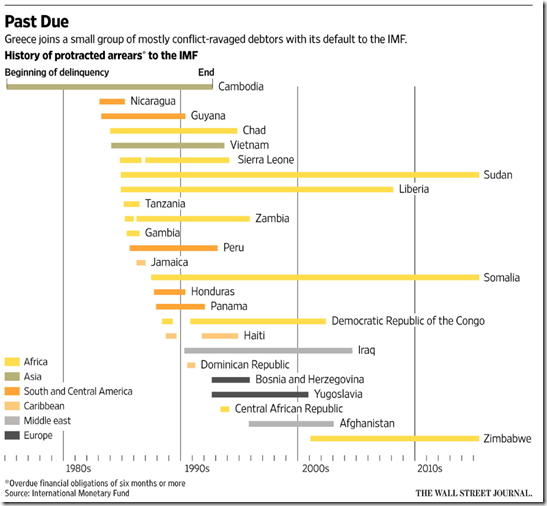

An example of this comes from this chart:

They haven’t put Greece on here yet. But I bet you when they do they make it a different color from what they now show as Europe. They’ll invent a new category because Greece isn’t just part of Europe (like Bosnia and Herzegovina, or the rump Yugoslavia). No, Greece is a member of the more exclusive European Union, and the even more exclusive European Monetary Union (aka the Eurozone).

Those distinctions are made because people want to believe that Greece is different … mostly because um … Aristotle went to school with someone you kinda’ sorta’ know.

This is nonsense. Greece has been a horribly run backwater on the edge of Europe since westerners forced its independence in 1830. It is in financial trouble with the Germans because the Greeks won’t lend to their own government, so its gone begging elsewhere. It was bailed out in 2010, and again in 2012, and already had the best terms for repaying its debt of any country in the EMU … before they spent the first half of 2015 begging for more.

The chart is drawn from the article entitled “Record Greek Default Deals a Blow to the IMF” that appeared in the July 1 issue of The Wall Street Journal.

***********************************************

Back to June 28, 2018

How is Greece more like the countries in the chart than the rest of the EU or EMU?

Well, for one thing, it’s most statist. Both Americans and Europeans view Europe as being more statist. By that we mean that the economy is more dominated by the government. (This is sort of an urban myth created by not counting the much larger sub-national governments that the U.S. has: when you count all levels, we’re about as statist as western Europe). But we all recognize that the private sectors of most European economies are filled with firms making things and doing business (you know … BP, Volkswagen, Carrefour, Fiat, Siemens, HSBC, Nestle, Bosch, ThyssenKrupp, Airbus, Unilever, Maersk, Nokia, Volvo, and who can forget the now Belgian Anheuser-Busch InBev). That list from Wikipedia contains no Greek firms in the top 150 European firms.

Stop for a minute. Can you name Greece’s largest business (other than tourism, which is dominate dby multinational firms everywhere)? You can’t, because they don’t do much. They do have firms, but I challenge you to find a name on this list that you recognize. This is what makes Greece statist: there isn’t much economy other than the state. Here’s Scott Sumner writing at EconLog in June 2015, from a post the broadly discusses why those on the left have trouble figuring out what’s wrong with Greece:

… Back in 2008, when I did research on neoliberalism in developing countries, I found that Greece was the least neoliberal economy in the developed world, according to a variety of metrics. Note that at this time Greece was booming, so this was not a question of people who liked neoliberalism calling Greece statist just because they wanted to peg that tag on a failed system. Indeed I was surprised that Greece did so well until 2008, despite being so amazingly un-neoliberal.

Of course we all know what happened next. The world discovered that the Greek boom was funded by unsustainable foreign borrowing, and that the Greek government lied about how much they had borrowed. When the huge debts were exposed, Greece had to sharply curtail its borrowing. Even worse, the eurozone crisis pushed Greek into recession. Greece is now widely seen as the worst economy in the developed world …

Sumner is right/libertarian, but I think he too suffers from the point in my thesis here that we’re giving Greece too much credit.

The research he refers to is here. It’s from 2008 when everyone was fooling themselves that Greece was like other EU or EMU members. Here’s the thing: there’s roughly 200 countries on the globe, and “developed” applies to the top 40 or so in GDP per capita. Greece is either at the low end of that range, or beyond it. And if we look at the Index of Economic Freedom (in the link at the start of the paragraph) Greece is ranked around 80th, between Honduras and Nicaragua. But what other countries are about 40th on the one list and about 80th on the other? Kazakhstan.

Do you think of Kazakhstan as developed? Probably not. Then don’t fool yourself that Greece is either … even if you think Lysistrata has some relevance to #MeToo.

† And if you don’t think the EU and EMU are tribal, you should read up on how they have slow walked admitting Turkey.‡ Even though Turkey is a lot more developed than most of the places between Istanbul and Brussels. Many international policy critics view Turkey’s turn towards Islam as partially resulting from being rejected. The Turks spent hundreds of years trying to get closer to the west, and the closest anyone ever let them come was joining the Central Powers in World War I.

‡ You can probably imagine what the slang phrase “slow walked” means, but if not you can find it in Urban Dictionary. Apologies in advance for any other NSFW things that catch your eye there.