This is the first number I've seen: Liam Peach from Capital Economics estimates that about 40% of Russia's foreign exchange reserves are now out of reach for use by Russia. Believe that 40% is of the roughly $650B they have. On the other hand, roughly 15% of that is held in China, where they're probably loving this, and China has been developing an alternative to SWIFT (CIPS) that clears transactions in yuan through Chinese entities rather than through dollars at western banks.

FWIW: Iran and North Korea were already been banned from SWIFT. They haven't gone away.

The legacy media overreports information on stock markets (I think they do this because it's easy data to obtain, and they don't have to figure out anything innovative). You should mostly ignore this. Way less important than they make it out to be.

In anticipation of one of you asking, yes, Russia could do the same sort of liquidity flood that the Fed and the ECB will have to do. The difference is that consumers and investors on this side want our money, while those on the other side may not. This is why interest rates in Russia have gone through the roof: it's for interest on ruble deposits paid out in more rubles.

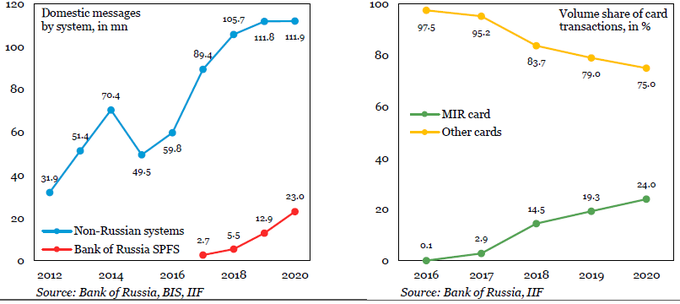

Here's a tweat storm covering the moves of Russia's central bank. There's a couple of interesting bits the journalists missed. First, if you successfully export from Russia, they want your 80% of your proceeds converted into rubles (which will put the foreign currency you obtained in the hands of the central bank to help shore up foreign exchange losses). Elina Ribakova speculates that Russians withdrew a trillion rubles from banks over the weekend. Interestingly, she also shows how Russia has created both its own alternative to SWIFT for internal transactions (in red), and a credit card for domestic transactions over the last few years (in green). Hmmm. Like they knew what was coming.

Do note that these are older numbers, and will not show anything from the past week.Instead, expect Russia to greatly drop the price of domestic energy. The harder it is to store (like natural gas, and perhaps electricity generated centrally with it), the cheaper it will get. Coal and oil ... not so much.

This is one example of what cutting them out of SWIFT does:

Moscow’s department of public transport warned city residents over the weekend that they might experience problems with using Apple Pay, Google Pay and Samsung Pay to pay fares because VTB, one of the Russian banks facing sanctions, handles card payments in Moscow’s metro, buses and trams.

In other news, Switzerland, which is not a member of the EU, and which has been the global place for non-judgemental banking for decades, has matched the EU's sanctions, and blocked personal accounts of Putin and others.

Our Fed this morning banned personal transactions with Russia's central bank. Those are smaller than institutional ones, and harder to trace. Good luck with that: probably just symbolic.

Do note that natural gas is still flowing from Russia to western Europe, even through Ukraine! There's a couple reasons for this. First off, if they ship the gas, they can still accept a promise of future payment. Second, the buyers in the west probably already have some accounts in Russia to pay for things, so this is a way for Russia to drain those accounts and get access to those funds. Third, and this is a more practical problem, it's fairly hard to just turn off natural gas at the wellhead (oil and especially coal are a lot easier to leave in the ground), and it's difficult, expensive, and dangerous to store.

***

I'm not sure this one is a good thing.

The Ukrainians have been announcing tallies of Russian casualties and machinery losses. Honestly, I think those numbers are a fantasy.

BUT, over the weekend, numbers very close to that were released publicly by TASS, the semi-official Russian news agency. So maybe not.

No comments:

Post a Comment