I did the work on this Sunday afternoon, but I'm only getting around to writing it up about 1 am. With the time difference of a little less than half a day, it's already morning over there, and maybe this is old news now. My bad.

The big news is the blocking of personal assets of Putin held in the west. There is reasonable suspicion that he may be the richest person in the world (but he doesn't seem to care much for spending it). Also, it's not clear how much of his personal wealth they can actually track down. But, he did say earlier that he would consider this an act of war. At this point ... whatever.

It took a few days, but the EU has moved forward with blocking Russian banks from SWIFT. I am not sure of the details on this, but I have read that this is a minor move now: the sanctions that had been piled on one-by-one over the last few days effectively accomplished this.

A bigger move is blocking the assets of the Russian central bank. Banks hold lots of their assets in accounts at other banks, so there is a lot of traceable wealth here. Much of this is what is called foreign exchange, as discussed earlier in the semester. So blocking this is a source of future exchange rate problems.

BP owns 20% of the Rosneft (the state oil company). They're going to divest. This is dumb. You can't divest unless someone will buy. The only ones who will probably be interested will be the Indians and the Chinese. This is a moral win for the UK, but a financial loss. It will be neutral for Russia, since this is a sale of seasoned stock, not an initial offering. And it will be a win for whoever buys it on the cheap. It would be hard to find a better example of why the general public needs better financial education.

Official exchange rate markets were closed for the weekend, but were expected to open at about 100 rubles to the dollar. There was a report of spot market trades at 171 over the weekend. Not sure if that's true or not.

Russians have been hitting ATM's hard, and where possible withdrawing foreign currencies rather than rubles. Without SWIFT, and access to their accounts in foreign countries, most banks won't be able to sustain that for long. Bank runs are possible. Not sure how facile Russian authorities would be in dealing with that.

Since 1936, Turkey had followed an international treaty regarding access to the Black Sea. They are allowed to shut off access if the Sea becomes a war zone. They have announced that they are moving forward with making this claim. This is important because it would reduce Russian tanker traffic through warmer waters in winter.

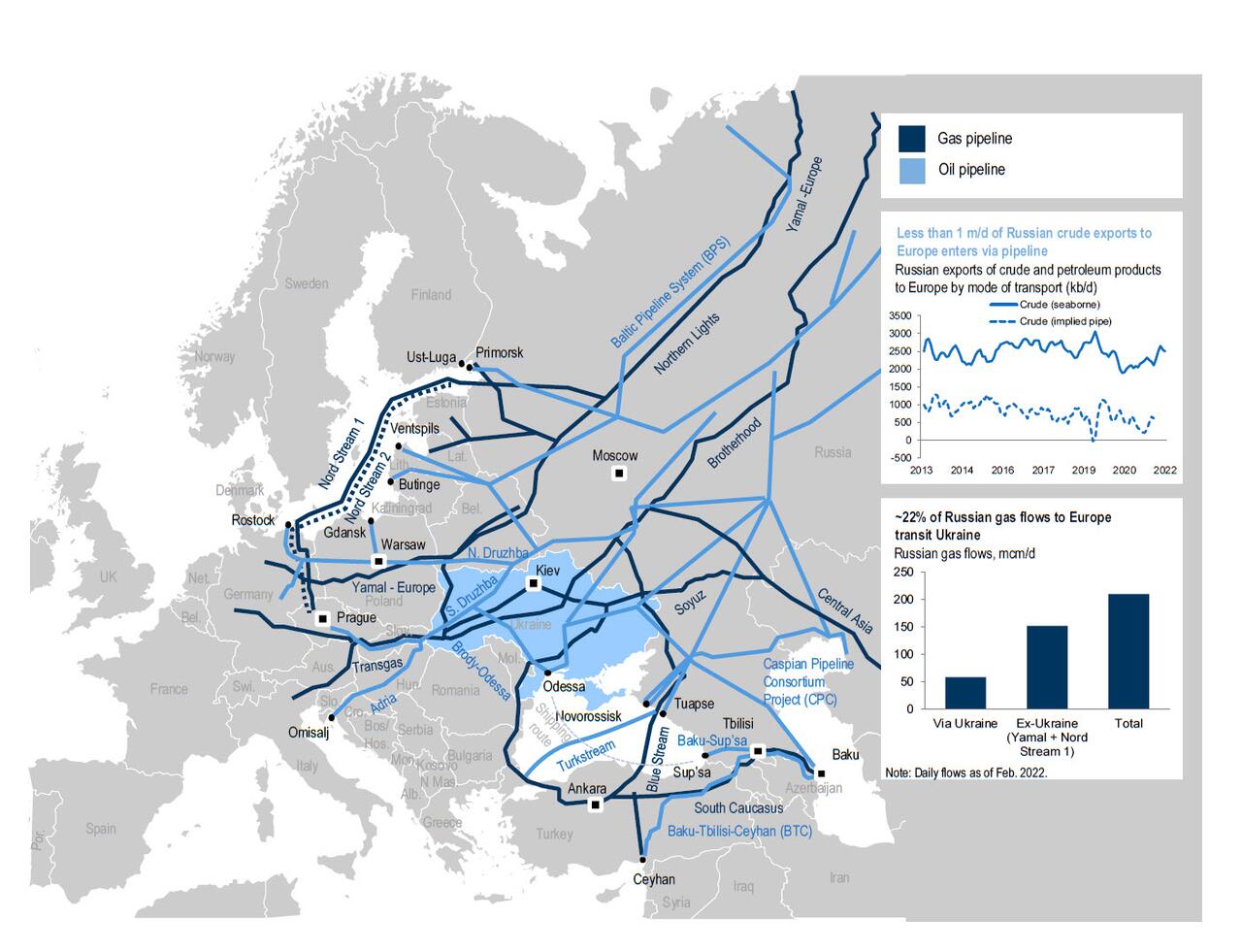

But western Europe has now effectively shut off gas and oil from Russia, since they can't make payments on deliveries. But, the map shows how integrated they are:

It's probably a good time to remind you all that "green" sources ... at least as far as the numbers and scalability go ... are a joke. Europe has no backup plan here, other than tankers from OPEC and the U.S. There's probably enough oil and gas out there to fill this hole, but there may not be enough ships. This means that shutting down all the financial stuff may be a gamble that Russia will break before they do. I'm not sure Russia will lose that.It's probable that the ECB and the Fed are going to go whole hog on regulating cryptocurrencies, just like Canada did. It will be interesting to see how possible this is. I think a lot of people are concerned that Canada showed that it might be fairly easy.

European airspace has been closed to Russian commercial planes, and it's probable that the last non-Russian flights are getting out of there at this time.

***

In all of this, you need to keep in mind that western banks have investments in Russia too. All those accounts will be locked up, and given Putin, potentially forfeited. There's likely to be financial problems here too.

The Fed has done a pretty good job, in 2008 and 2020, with flooding the financial system with liquidity in crises. There may be a difference this time though. Financial systems can have liquidity problems and solvency problems. The former is when you can't turn your non-liquid assets into liquid ones fast enough. Easy to solve if the central banks pumps in liquidity. The latter are when you can't convert your non-liquid assets into much of anything at all, because they've lost value. More liquidity can help with that, but it won't solve the problem. I think the general hope behind all the sanctions is that Russian financial institutions need ours a lot more than we need theirs.

Another concern is loans by western European banks to Russia and Russian firms. Those bonds are assets to those western banks, and the payments are their cash flow. Russia will quickly default on those loans. What happens to those banks? Of course, the European Central Bank can flood them with liquidity, but this is also is a solvency problem on the horizon.

No comments:

Post a Comment